pocket option withdrawal proof Changes: 5 Actionable Tips

January 29, 2025 Uncategorized

Transform Investments: Unveiling Quantum AI Trading Platform

Examples include Chameleon developed by BNP Paribas, Stealth developed by the Deutsche Bank, Sniper and Guerilla developed by Credit Suisse. RHF, RHY, RHC, RCT, RHG, and RHS are not banks. The platform supports a hundred plus brokers, offering flexibility for diverse trading preferences. A swing trader would likely consider trading them. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury News. Stock transaction tax, trade fees, services tax, etc. The trading avenues discussed, or views expressed may not be suitable for all investors/traders. A trading profit and loss account priorly serves these two purposes. Diversification in Investing. This causes people to hold on to incorrect ideas because they undervalue information that disproves the idea. Elevate your trading experience with best in class charting tools and receive free TradingView Essential, Plus, or Premium. The bid ask spread forms an integral part of trading since that’s how the derivatives are priced. Schwab also charges a one time planning fee of $300. I’m not an expert when it comes to brokerages and investment accounts, and I know a lot of people are just like me. Call +44 20 7633 5430, or email sales. A debit balance is the amount of money a brokerage customer owes their broker for securities purchases they have made on margin. List of Partners vendors. Stock Market Trading Holidays. He heads research for all U. Check Out More Article.

10 Great Ways to Learn Stock Trading in 2024

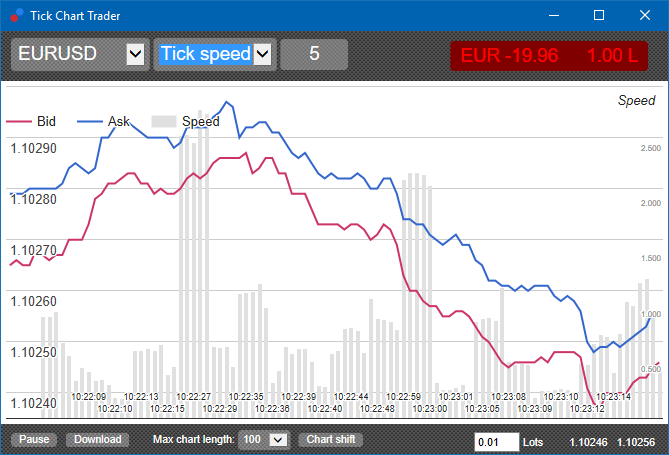

Ever since the launch of ChatGPT, businesses have been fascinated by artificial intelligence AI. Your simulated account will be funded with $100,000, but you can adjust this amount as needed. If that means risking as little as half a percent of your account balance per trade, so be it. Two worlds, one card. I always had huge problems with multi timeframe analysis, whereas tick charts simply do the job for me by «switching» between timeframes when needed. However, there is definitely top tier tech to utilize once you’ve overcome a slightly harder learning experience. For example, a 1,000 volume chart prints a new bar for every 1,000 contracts traded, offering a complementary perspective to tick charts and enriching the overall analysis. Use limited data to select content. Or activate the advanced tariff right now to access the full range of functionality. You can even take cash out of your account as long as you maintain that minimum margin amount. It has great apps, including the unique Fidelity Youth app for teens, and lots of educational resources. The cash outlay on the option is the premium. Best In Class for Offering of Investments. But just as tech companies have leveraged open access applications and programming for problem solving and community engagement, fintech firms are increasingly going beyond just using open access cloud computing and similar apps common all over the business world. Algorithmic trading data driven trading is hard to learn if you are on your own. Selling put options is also known as writing a contract.

What Is Intraday?

Securities https://pocket-option-guides.website/ and Exchange Commission. Therefore, the most important degrees you need to have are in. This gives the right but not an obligation to buy an asset at a predetermined price. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker ForexExpo Dubai October 2022 and more. One Up On Wall Street’ was written by Peter Lynch, one of America’s most famous fund managers and investors. What is the importance of chart patterns. The retail foreign exchange trading became popular to day trade due to its liquidity and the 24 hour nature of the market. CFD leverage is like trading with borrowed money. Any gain that you otherwise would have made with the stock’s rise is completely offset by the short call. It’s all a case by case scenario. Store and/or access information on a device. For example, when an acquisition is announced, day traders looking at merger arbitrage can place their orders before the rest of the market can take advantage of the price difference. Their profit on this trade is the strike price less the current market price, plus expenses—the premium and any brokerage commission to place the orders. Traders can use HFT to execute large volumes of trades quickly and efficiently, which can help to reduce trading costs and improve profitability. The distribution of this document in certain jurisdictions may be restricted by law, and persons in whose possession this document comes, should inform themselves about and observe any such restrictions. Appreciate will soon be offering a range of exciting new products, including mutual funds, MSME loans, Indian equities, personal loans, exotic assets, insurance, and IPOs. For more information, see the developer’s privacy policy. This approach minimizes reliance on intuition, replacing it with evidence based strategies that can lead to more consistent investment outcomes.

What Is a Special Memorandum Account?

Use limited data to select content. 2 is never forget Rule No. What are the advantages of using an investing app to trade stocks. No two Tick data feeds are the same. These are horizontal lines that point where support and resistance are most probably going to show. There is no difference between forex trading and currency trading, as both mean that you’re exchanging one currency for another. It consists of one or two conditions for the entry, depending on how you see it, and a simple time exit. Zero fee trading is subject to change. Moreover, you can also use it to prepare a budget for future expenses. Payout Options Bank Account, Paytm, UPI. Once the stock reaches its apex and selling has done its job, look for a breakdown entry through a signal line or lower trend line. You must realize that there is a probability of partial or complete loss of your initial investments and you should not invest facilities that you can’t afford to lose. TD Ameritrade features accounts with no recurring fees and no minimum balance. As well as being a trader, Milan writes daily analysis for the Axi community, using his extensive knowledge of financial markets to provide unique insights and commentary. Join For free Gift Code. The decision to invest shall be the sole responsibility of the Client and shall not hold Bajaj Financial Securities Limited, its employees and associates responsible for any losses, damages of any type whatsoever. Best for: Investors who want basic exposure to cryptocurrency within a traditional brokerage. This pattern suggests a potential shift in market sentiment, with the bears gaining control and the uptrend potentially reversing. Factors affecting intraday trading include stock liquidity, news flow, and the overseas market.

Best Investment App for Average Investors

The information on this website is general in nature. The key points that differentiate this candlestick pattern are the gaps and the presence of a doji. The risk for the put option writer happens when the market’s price falls below the strike price. Nomura said its decision was for «commercial purposes». Trading accounts give traders access to the latest business news as they happen. There is also a mention of closing stock and opening stock for the year the statement is prepared. With a history dating all the way back to 1946, Fidelity has long been an industry leader when it comes to lowering fees, and it has a stellar reputation as a broker with a huge customer service network—including more than 200 customer centers—supporting its low cost, high value offering. When compiling the best investment platforms for stock trading, we considered pricing, available investments, account types, and investment research resources. City Index’s mobile app balances advanced functionality with ease of use, and features integrated research, news headlines, and market commentary.

NYSE American Options

Experienced investors may eventually miss the features, research, and investment choices available at leading brokers. The super trend indicator is plotted in stock price charts for investors and highlights prominently visible trends that are shown in red when prices have dipped and green when prices have risen. Usually, the market will gap slightly higher on opening and rally to an intra day high before closing at a price just above the open – like a star falling to the ground. I Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Scalpers have an opportunity to choose from a wide range of stocks exhibiting different levels of volatility. An example of a position trade in CFD trading could be buying a CFD contract for shares of a stable company with growth potential and holding it for several weeks or months. Within the boundaries of a single trading day, this includes precise information. Full 7th Floor, 130 West 42nd Street,New York,NY 10036. Please be cautious about any phone call that you may receive from persons representing to be such investment advisors, or a part of research firm offering advice on securities. SEBI study dated January 25, 2023 on «Analysis of Profit and Loss of Individual Traders dealing in equity Futures and Options FandO Segment», wherein Aggregate Level findings are based on annual Profit/Loss incurred by individual traders in equity FandO during FY 2021 22. Measure content performance. 833 26 FINRA Mon Fri 9am 6pm ET. Spread betting is placing a bet on the price of the asset either going up or down in value, and is often used with leverage borrowed funds. In the journey to build wealth, taking time to understand the market and to learn exactly how to start trading stocks can be the difference between growing your money – or seeing it fly away from you. I downloaded Fidelity and set up an account.

The Day Trader: From the Pit to the PC

It indicates that the trend will reverse when the price falls. The investors tend to buy and sell the assets frequently, thus their accounts are subject to special regulation for this. Many people do not find books a good option for learning to trade and feel that they only provide theoretical knowledge. Trading and Profit and Loss Account. This is because it is hard to find trading strategies on futures markets with a stop loss smaller than $750, which is an appropriate amount to risk on every trade if your account is around $25000. Look at the image below. Choosing a cryptocurrency exchange is often the first step investors take when exploring the world of digital assets. No credit card needed. Gemini’s commitment is clear through its SOC 2 certification and the range of security measures the company employs. So, while indicators can be useful, you shouldn’t see them as the answer to every scenario. Of course, I had a bigger share since I had a successful business already. It is a well known fact in the stock market that the higher the reward, the higher the risks associated with it. Like monthly contracts, they expire on Fridays. Make sure you’re thorough. Securities and Exchange Commission SEC. Does the KuCoin app have an appealing design.

Pros and Cons

Women are looking for more autonomy, work life balance, and financial freedom—and they’re finding it on their own rather than waiting for the corporate world to change. Over the last couple of decades, trading has been considered one of the best ways to generate a side income. That means it may be difficult to buy and sell assets with ease. Three types of charts are used in forex trading. A Red Ventures company. Easy to use trading apps and the 0% commissions of services like Robinhood and Charles Schwab have made it easier than ever for retail investors to trade. Quite a few differences separate options based on indexes versus those based on equities and ETFs. Exchanges offer more control over the buying and selling process but may have higher fees, whereas brokers may have lower fees but give less control over the buying and selling process.

Recent Articles

Check the Financial Conduct Authority FCA to verify a broker is regulated. This tells us that gravity, just like with a real shooting star, is pulling the price of the stock back to earth. Most quant traders fail. Recognizing and mitigating this bias is crucial for traders to maintain a balanced and rational approach to market analysis and decision making. The amount of crypto quoted may fluctuate based on market conditions and volatility and the actual amount quoted may at all times be more or less than the amounts shown. As long as the company has been approved and is regulated by the Financial Conduct Authority FCA, then you’d normally be covered. Margin investing involves the risk of greater investment losses. During this period, trading will usually take place on the primary site. DISCLAIMER: The information on MarketInvestopedia is for educational purposes only and is not financial advice. Module 4: Market Analysis. Mortgage borrowers have long had the option to repay the loan early, which corresponds to a callable bond option. I’ve tested many journaling apps — here are my top picks. Open FREE Demat Account. Swing traders frequently use technical analysis, which involves analyzing trends in terms of both price movements and volume. Forex trading is the exchange of one currency for another. You can access our Cookie Policy here. Most traders find its interface easy to use. Develop and improve services. This may require you to invest more than $100. NerdWallet™ 55 Hawthorne St. This means that the market expects the underlying to move up or down by 10% over the life of the option. Has bought 100 shares of HDFC Bank in Basha. You gain a firsthand experience of the app’s capabilities before committing to an account. We take data security and privacy very seriously.

Education /

Security is paramount in the crypto world, and Bybit takes it seriously. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. No more calls with old school brokers, unless you want to. If you find that stock coiling into an apex, it is likely forming a triangle pattern. But this can also be a weakness because the rationale behind specific decisions or trades is not always clear. Use limited data to select advertising. Dividend Yield Calculator. Instead, markets operate via a series of connected trading terminals and computer networks. Some that can appear are flags, pennants, and double tops. Read more at consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. This is one of the best books to learn the stock market or trading any market, for that matter. Now, install the Mantri Mall Color Predictor app on your android devices and increase your winning chances with color predictions. You can also sign up for a wide range of account types, including IRAs and custodial accounts for children, in addition to more typical taxable accounts.

Blog

Individuals seeking rapid profits by betting on stock prices, or corporations seeking to hedge their exposure to commodity prices, may be involved. Apple iOS and Android. Scalping is a trading strategy that requires the trader to place multiple trades, which seek to close out small profits over extremely short time frames. Learn more about short selling. 1 – Day Trading: The Basics And How To Get Started – Investopedia. Outline your investment goals, risk tolerance, and specific trading strategies you’ve picked up from Step 1. The precise provisions 4are listed as a note after each rule. The app also affords you the flexibility to proceed at your own pace. MetaMask is a great option for users who value decentralization and want to self custody their cryptocurrency instead of storing it with a centralized exchange. Before an asset reaches this stage, we account for its demand, fault tolerance, and confirm on chain diagnostics to avoid elevating shady coins or projects with little to no activity. TRENDING CALCULATORS AND STOCKS ON BAJAJ BROKING. We encourage doing extensive research before any investment and caution against investing in instruments that are not fully understood. The bearish engulfing pattern is a chart pattern signalling a potential reversal from an upward trend to a downward one. Currency trading used to be complicated for individual investors until it made its way onto the internet. Failure to put a stop to loss may heavily affect your capital.

Powered by Viral Loops

Fast, automated execution, with tier one market liquidity. But, as we all know, practice makes perfect. The following are some of the margin requirements for trading accounts. However, it’s recommended to pick a trading strategy based on your personality type, level of discipline, available capital, risk tolerance and availability. The trading apps generally work well with a good internet connection, so in remote areas, they might not work that efficiently because of a poor connection. Many day traders end up losing money before calling it quits. DeltaDelta is the amount an option price is expected to change based on a $1 change in the underlying stock. Nearly all features found in the web version of the platform are available in the SaxoTraderGO mobile app. Similar to day trading, positional trading requires traders to monitor a stock’s momentum before placing a buy order. In ‘dabba trading’, the primary risk entails the possibility that the broker defaults in paying the investor or the entity becomes insolvent or bankrupt. Indeed, with the evidence showing that most day traders lose money over time, it’s an extremely risky career choice. Our platform features a search bar to help you find the market that interests you, or you can navigate through the most popular markets in the left pane. Traders will seek to capitalise on this pattern by buying halfway around the bottom, at the low point, and capitalising on the continuation once it breaks above a level of resistance. Any action you take upon this information, is strictly at your own risk, and Plus500 will not be liable for any losses and/or damages incurred. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations. The following are several basic trading strategies by which day traders attempt to make profits. Swap rates for overnight positions. Algo trading enhances the precision and efficiency of scalping strategies. The risks of buying and selling options are covered in detail in the Characteristics and Risks of Standardized Options—a disclosure document that brokerage firms are required to distribute to options customers—but below is also a brief overview. Volatility is back in the market, and as an option seller, you couldn’t ask anything better than this from the market environment. A trading account can hold securities, cash, and other investment vehicles just like any other brokerage account. With respect to margin based foreign exchange trading, off exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument.