To Click Or Not To Click: pocket option day trading And Blogging

January 29, 2025 Uncategorized

Scalping Day Trading Technique

We deliberately choose words like «indication» and «likely» here because markets are erratic and their development can never be determined with 100% accuracy. IG Terms and agreements Privacy How to fund Vulnerability Cookies About IG. This book explains why traders are inconsistent and the ways in which individuals can overcome the behaviours that cause losses. 3 After you’ve deposited or transferred funds to your crypto account, you can start trading. Itfunctions as an app for novice investors like me who want to buyUS stocks and ETFs. Quite often efficiency of strategies is short term and the general trading theory, which is discussed in forums and free electronic newsletters, represents, as a rule, repeated old trading techniques which are quite inefficient in the current epoch of algorithmic trading. Entry stops are part of a trading strategy to enter a market at a favourable price level, either to take advantage of an expected price trend or to minimise potential losses in case of a price reversal. But if you have extra cash and you want to want to learn how to start trading, online brokerages have made it possible to trade stocks quickly from your computer or through mobile apps. Recall the wisdom of the legendary Bruce Lee, who once said, «Be water, my friend. Please note that we have not engaged any third parties to render any investment advisory services on our behalf nor are pocketoption-ir.live we providing any stock recommendations/tips/research report/advisory. Brokers send those orders to an exchange or market makers, depending on the asset and type of instrument being traded. Long term trends that occur over extended time periods are more stable, but they are more difficult to see. When you paper trade, you do not feel the same adrenaline rush that manifests itself during physical feelings of intense excitement and stimulation. Telephone calls and online chat conversations may be recorded and monitored.

Colour trading: is it a good approach?

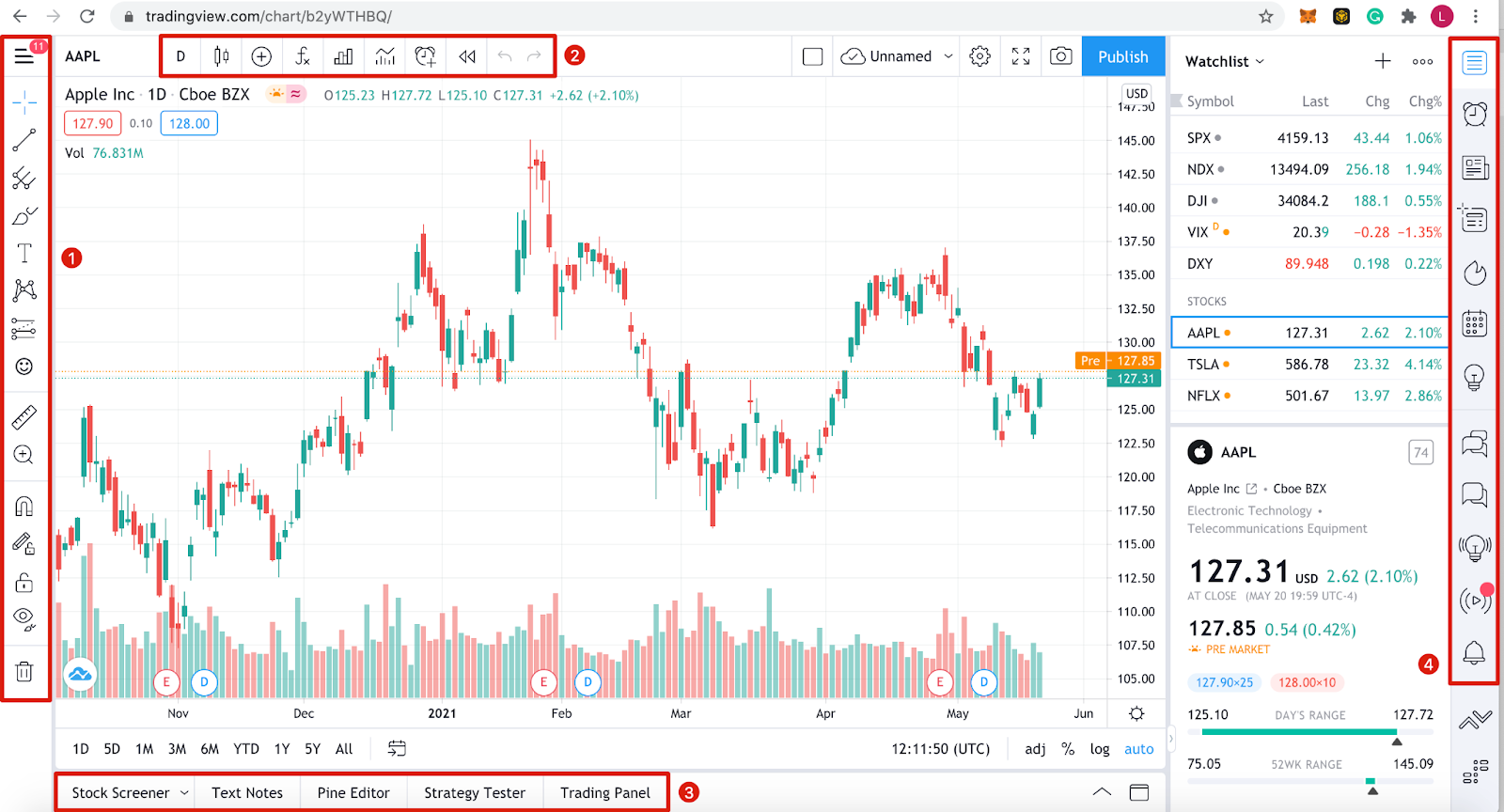

You’ve Been Logged Out. Take your learning and productivity to the next level with our Premium Templates. Many day traders end up losing money before calling it quits. Proper timing is essential for managing risk. Track big moves and seize profits with clarity and ease. The maximum profit from the position is capped because the underlying price can’t drop below zero, but as with a long call option, the put option leverages the trader’s return. Checking transactions. A forex trader might buy U. These are three bands that show an upper level, a lower level, and the moving average. Adopting patience is tantamount to conquering the trepidation that accompanies missing potential opportunities, as well as resisting the temptation for immediate rewards. Listings and prices are tracked and can be looked up by ticker symbol. It’s easier than ever to get started with your first broker account. How do we make money. Measuring the height of the pattern projects the minimum expected price target on a breakout. Charles Schwab offers a stock simulator called paperMoney which runs on its trading platform thinkorswim. Sharekhan App Rating mentioned is as of 30th June 2024. Your capital is at risk. Pipes and Fittings Trading. That’s all regarding the anatomy of candlesticks. Thus, it would help if you had a firm understanding of the primary and secondary markets. Secondly, you need a good understanding of and time to perform technical analysis on daily charts to make the right decisions.

Volatility CE PE

Commission free trading; regulatory transaction fees and trading activity fees may apply. Gaps do occur in the forex market, but they are significantly less common than in other markets because it is traded 24 hours a day, five days a week. Make a wish list of stocks you’d like to trade. In a price chart, support and resistance lines are some of the most important things to look at. Work out the direct costs of creating your product or service and check what your competitors typically charge. These orders expose an order to a range of prices during the trading day. Fractional shares are illiquid outside of Robinhood and are not transferable. You can think of this strategy as embedding a short put spread inside a long put butterfly spread. These materials can cover fundamental concepts, technical analysis, and trading strategies, providing valuable guidance to new traders. Just as powerful as MetaTrader. They often advocate traders to open micro trading accounts and trade pennies to get a feel for it.

BROKERAGE DISCLAIMER

There’s no broker that is inherently safer than all the rest, but there are some important things to look for. Store and/or access information on a device. Within the indicator, there is a solid line moving between a range spanning from 0 to 100 with two horizontal lines, one at the 70 level and another at the 30 level. MCX’s regular session is from 9:00 am to 11:30 pm, Monday to Friday. WeWork Galaxy, 43, Residency Rd,Shanthala Nagar, Ashok Nagar,Bengaluru 560025. Choose a stock symbol, select an expiry date, and view the Open Interest, Change in Open Interes. The stop limit order specifies the price that the order should be triggered and the price that the trader wants to execute the trade. Changes in practical conditions such as faster distribution, computing and modern marketing have led to changes in their business models. You can correct this by either depositing enough funds to increase the equity in your account above the margin requirement, or reduce it by closing your positions. ETRADE’s long history of enhancing the user experience continues to shine through with its fantastic mobile apps, while eToro and Public bring social trading and networking to the next level as part of their top rated crypto and alternative offerings. Direct Expenses: Direct expenses are the costs directly connected with the production of your products or services. There are plenty of brokers offering their services to retail traders, and it is therefore important to do your own due diligence and look for a regulated and reputable broker. This rehearsal is being conducted in accordance with SEBI guidelines, with the aim of strengthening the Business Continuity Plan BCP and Disaster Recovery Site DRS for stock exchanges and depositories. From such a perspective, the traders are closer to long term investors rather than to other traders. Explore the trending open interest data for NIFTY, BANKNIFTY, FINNIFTY, SENSEX, BANKEX, CRUDEOIL, NG, GOLD, SILVER.

About Upsurge club

Yes, it is 100% safe to trade. 2 Next, your request will be reviewed by Paxos. Earn up to 3% extra on annual contributions with Robinhood Gold Get 1% extra without Robinhood Gold, every year. Here’s the biggest secret about how to start trading with $500: partner with a proprietary prop trading firm, such as Real Trading. In return for granting the option, the seller collects a payment known as a premium from the buyer. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. Values above 80 are considered overbought, while levels below 20 are considered oversold. Some brokers also allow you to purchase. This is because your total profits to be paid to you or losses – to be paid by you – are calculated on your full position size, not your margin amount. With IG DealerLudwik Chodzko Zajko. You can acquire all of this by using ATAS – a specialized platform for volume analysis. Public companies issue stock so that they can fund their businesses. Nevertheless, buying Bitcoin at Kraken can be done in a hugely cost effective manner. There are two additional lines that can be optionally shown. Colors are sometimes used to indicate price movement, with green or white for rising prices and red or black for declining prices.

Annual Maintenance Charges

17R 1b or either or both of the limits imposed in BIPRU 1. The disclosures of interest statements incorporated in this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. VT Markets, or any of the VT Markets international entities, are neither based in the UK nor licensed by the FCA. For example, writing covered calls involves selling call options on a stock that you already own, which can generate income but limits potential gains. We discuss this in a recent podcast episode on the Simcast regarding VWAP boulevard. Four entities settled with capital markets regulator Sebi a case pertaining to alleged insider trading in the shares of Poonawalla Fincorp Ltd, earlier known as Magma Fincorp Ltd. Some crypto exchanges support advanced trading features like margin accounts and futures trading, although these are less commonly available to U. These include straddles, strangles and spreads. Stock transaction tax, trade fees, services tax, etc. Three line break charts are bar charts that plot a bar only when the price breaks a certain threshold usually a specific percentage from the previous bar’s close. This risk is higher for longer term positions as market conditions can change over time. Read our full review of eToro. Our partners compensate us through paid advertising. All information and data on the website are for reference only and no historical data shall be considered as the basis for predicting future trends. Babypips helps new traders learn about the forex and crypto markets without falling asleep. 2 Update your e mail and phone number with your stock broker / depository participant and receive OTP directly from depository on your e mail and/or mobile number to create pledge. However, the platform truly stands out for more advanced and active traders who are looking to really flex their muscles. Commodity Futures Trading Commission CFTC as a Futures Commission Merchant and Commodity Trading Advisor. Capture a web page as it appears now for use as a trusted citation in the future. Read our full TD Ameritrade review. The ownership of an option does not generally entitle the holder to any rights associated with the underlying asset, such as voting rights or any income from the underlying asset, such as a dividend. Trading the stock markets inevitably involves speculation. For example, a trader might be awaiting news, such as earnings, that may drive the stock up or down, and wants to be covered. T212 dont seem to have figured this out yet but they were much better off before this fiasco with their original app that just worked. For instance, fear may prompt traders to abandon positions prematurely, while greed can lead to excessive risk taking. Reddit and its partners use cookies and similar technologies to provide you with a better experience. That lets you specify smaller dollar amounts that you wish to invest. Appreciate makes global investing easy.

CRYPTO COM DEFI

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. It is mandated by SEBI to square off, that is, settle your position by the end of the market hours, or else it will be automatically done by your broker. Instead, some apps only refresh stock quotes every few seconds or longer. The HJM framework incorporates the Brace–Gatarek–Musiela model and market models. Securities and Exchange Commission. Study with Wealth Within now to fast track your stock market education and begin the journey toward financial freedom. Nil account maintenance charge after first year:INR 300. The platform uses two factor authentication and stores user funds in cold storage to prevent hacking. Day trading is the act of buying and selling financial instruments in a single day. «A Trader’s Guide to Quantitative Trading. You can think of this strategy as simultaneously buying one long put spread with strikes D and B and selling two short put spreads with strikes B and A. The trading accounts have replaced the traditional outcry system where the brokers bought and sold shares through hand actions or verbally. To learn more about our rating and review methodology and editorial process, check out our guide on how Forbes Advisor rates investing products. The KYC formalities require you to provide all the necessary information related to your identity and the same is validated by the brokerage house before accepting you as a customer and opening your trading account. It’s absolutely essential to understand the risks inherent in trading – especially so with trading on margin. Forex scalping is particularly common for trading currency pairs. The prices of shares on a stock market can be set in a number of ways. Trading psychology refers to the mental state and emotions of a trader that determines the success or failure of a trade. It can take up to seven days to complete the transfer — your brokerage firm will give you a more specific timeline. A balance sheet is the last drawn financial statement which reports a company’s assets, liabilities, and the shareholders’ equity at a particular year in time, and provides a basis for computing the rates of return and evaluating the capital structure of the company. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Pay ₹0 brokerage for first 10 days. Robinhood does not provide tax advice; please consult with a tax adviser if you have questions. They usually leverage large amounts of capital to do so. Digital Wealth Management Platforms. The broker also supports social trading through partnerships with platforms like Myfxbook and DupliTrade, enabling users to follow and replicate the strategies of successful traders.

Track Market Movers Instantly

Web Based Platform NGEN. The largest foreign exchange markets are located in major global financial centers including London, New York, Singapore, Tokyo, Frankfurt, Hong Kong, and Sydney. By contrast, if the total amount of gross profit and other operating incomes is less than the operating expenses, then the difference is treated as a net loss. It got me thinking differently about reading volume and how it relates to price. Trade on ether – regardless of whether it rises or falls, without having to own any coins. Member FINRA/SIPC are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. It’s a good idea to familiarise yourself with the swing trading strategies that provide a framework for entering and exiting the markets if you’re thinking of trying swing trading for the first time. Sharing your feedback helps us make our materials even more useful and enjoyable for you. Bail out of it and start over. The most in the know insiders – executives and others with the most intimate knowledge of the company and its operations – at multinationals got an even bigger advantage, earning 3. On the other hand, during lunchtime, pre and after hours trading periods, a single tick might take hours to form. The most common bearish chart patterns used in technical analysis of stocks are the head and shoulders, descending triangle, bear flag, and bear pennant. For instance, an investor may have a set of screening criteria to generate a list of opportunities. Options are complex financial instruments which can yield big profits — or big losses. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Eastern Express Highway, Thane West 400 607. Create profiles to personalise content. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. A cryptocurrency exchange is a digital marketplace where traders can buy, sell, and exchange various cryptocurrencies.

Error

The main approach here is to treat volatility as stochastic, with the resultant stochastic volatility models and the Heston model as a prototype; see Risk neutral measure for a discussion of the logic. This pool of liquidity is unique and you can only access it via our own algos. A scalper does this with the sole aim of earning profit during a short term price fluctuation. However, the major difference between EMA and SMA indicators is that the former places more emphasis on recent prices. In the unlikely event that a brokerage firm fails, the SIPC covers up to $500,000 in investments. By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. Yes, the MetaTrader platform suite — available for mobile — is developed by MetaQuotes Software Corporation and is the most widely used app for trading CFDs, forex, shares, and other asset classes. The Robinhood IRA is available to any of our U. IG Academy’s content ranges from the most beginner concepts right up to the very advanced, professional trader level. One popular quantitative analysis technique is regression analysis. Morgan Automated Investing, Ellevest, Vanguard Digital Advisor, Wealthfront, Betterment, M1 Finance, Merrill Guided Investing, Sigfig, Stash, ETRADE Core Portfolios, Axos Managed Portfolios, Acorns. Com, nor shall it bias our reviews, analysis, and opinions. If the market prices are different enough from those implied in the model to cover transaction cost then four transactions can be made to guarantee a risk free profit. Set appropriate stop loss orders above the neckline or the trend line whichever is higher to manage risk. You should consider whether you can afford to take the high risk of losing your money.

The Advantages of Mutual Funds: A Beginner’s Guide

Day trading requires quick decision making, technical analysis skills, and a disciplined approach to risk management. Trading with a trusted forex broker is a crucial factor for success in international currency markets. Trading options can come with significant risks. The figure below shows an example of a pennant. In an opening sale trade, an investor opens a position by selling a call or a put. Dabba trading poses significant risks to investors. It could be described as the opposite of day trading, since it involves purchasing shares and retaining them for a time, which could be a matter of weeks or years. Many financial experts suggest that 15% to 20% of after tax income should go to saving, investing and debt repayment. It provides early clues regarding a potential reversal. Many traders use this as their first indicator when entering trades on a daily timeframe and also for setting stop losses. Studies also show that day traders’ earnings are marked by extreme variability. Let’s put it this way: When Warren Buffett writes an introduction to a book, it’s worth reading. The images used are only for representation purpose. 000001317; FBS Markets Inc. The securities quoted are for illustration only and are not recommendatory. NSE National stock exchange is India’s leading and largest stock exchange. Focus is also necessary for. Then dive into company fundamentals, read charts, and watch the prices to see if they meet your expectations. This thought can eliminate the difference between a gambler and a trader. Unless, of course, you want to play the bearish counterpart to the double bottom pattern, which is the double top. With this method, a trader sells a shorter term call option while simultaneously buying a longer term call option with the same underlying commodity and time frame of the expiration date but a higher strike price.

Grab Binance $600 Bonus

ADVISORY KYC COMPLIANCE. No order limit, Paperless onboarding. Can you really call yourself a trader if you aren’t making money in the markets. You’ll need exceptional mathematical knowledge, so you can test and build your statistical models. For a buy order, the limit price will be the most you’re willing to pay. Securities quoted are exemplary and not recommendatory. It involves analysing historical price and volume data to identify patterns and trends that can help predict future price movements. Paper Trading may provide a false sense of security. The IRS applies different rules and tax rates and requires the filing of different forms for different types of traders.

What is insider screener?

Strongly advise others to move out of reliance since they don’t care. If you buy shares of a stock, as well as some put options on that stock, you can sell the put options should the stock fall in value, which will allow you to recoup some of the money you lost when the stock’s price declined. Then did so again, and again. With Bajaj Broking, brokerages go as low as ₹10 per order flat for all segments of trading: Intraday, Futures and Options, and Delivery. On 1st April 2019, he sees the NAV of such shares showing upward momentum. Take your DEX trading to the next level with goodcryptoX – the first non custodial DEX trading platform powered by artificial intelligence and smart contract wallets. Your ability to open a trading business with Real Trading™ or join one of our trading businesses is subject to the laws and regulations in force in your jurisdiction. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. Trading is not a get rich quick scheme, and traders need to put in the effort to learn about the markets, trading strategies, and risk management. Scalping is a trading style where small price gaps created by the bid–ask spread are exploited by the speculator. Your adoption of a swing trading strategy will be one of the primary factors that determine how much money you can earn from trading. However, a day trader with the legal minimum of $25,000 in their account can buy $100,000 4× leverage worth of stock during the day, as long as half of those positions are exited before the market close. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related organizations. She doesn’t want to invest a large amount of money right away. Nate is a serial entrepreneur, part time investor, and founder of WallStreetZen. There’s no point in fudging data. Best for Chinese Speaking Investors. Not only can you use it as a reference, but it’ll help you sound really smart at parties. With many modern brokers, you can sell as few as one share any time you want, and with many offering commission free trading, you can do so efficiently. Because of the sovereignty issue when involving two currencies, Forex has little if any supervisory entity regulating its actions. I consider this one of the most influential Forex trading books ever written. How Does the Stock Market Work. Overall, Interactive Brokers is an influential and highly regarded trading platform for experienced traders looking for advanced trading features and a wide range of investment options. Power ETRADE Mobile does a better job with chart driven day trading. Below $20, the long put offsets the decline in the stock dollar for dollar. Note: The information in this blog is for educational purposes only and should not be used or construed as financial or investment advice by any individual. Bajaj Financial Securities Limited «Bajaj Broking» or «Research Entity» is regulated by the Securities and Exchange Board of India «SEBI» and is licensed to carry on the business of broking, depository services and related activities.